Since mid-March, business' have shuttered and unemployment numbers have set records.

Heading into the month of May, some homeowners are struggling to find the money to pay mortgages.

The $2.2 trillion stimulus provided help for some homeowners under the CARES Act.

It requires lenders to provide forbearance, a temporary postponement of payments to any homeowner with a federally-backed mortgage up to 180 days.

To clarify, forbearance allows a person to pause monthly payments, but you still owe the money.

The way it works is most banks will take the total amount you've paused and then adjust your monthly payments to include the total, averaged out over the time left on your loan once you start paying again.

Best case scenario is some are offering to extend your term for however many months you've pushed back.

The process starts with a conversation between you and your lender.

"They have a lot of wiggle-room to work with you now, but fall behind a couple of months and they've got to chase you down, that's when the options are going to be a lot thinner," Greg McBride at Bankrate said.

Forbearance requests are popular, up 1,896% between March 16 and march 30, according to the mortgage bankers association, a trade group that represents the mortgage industry

This trend is continuing to grow.

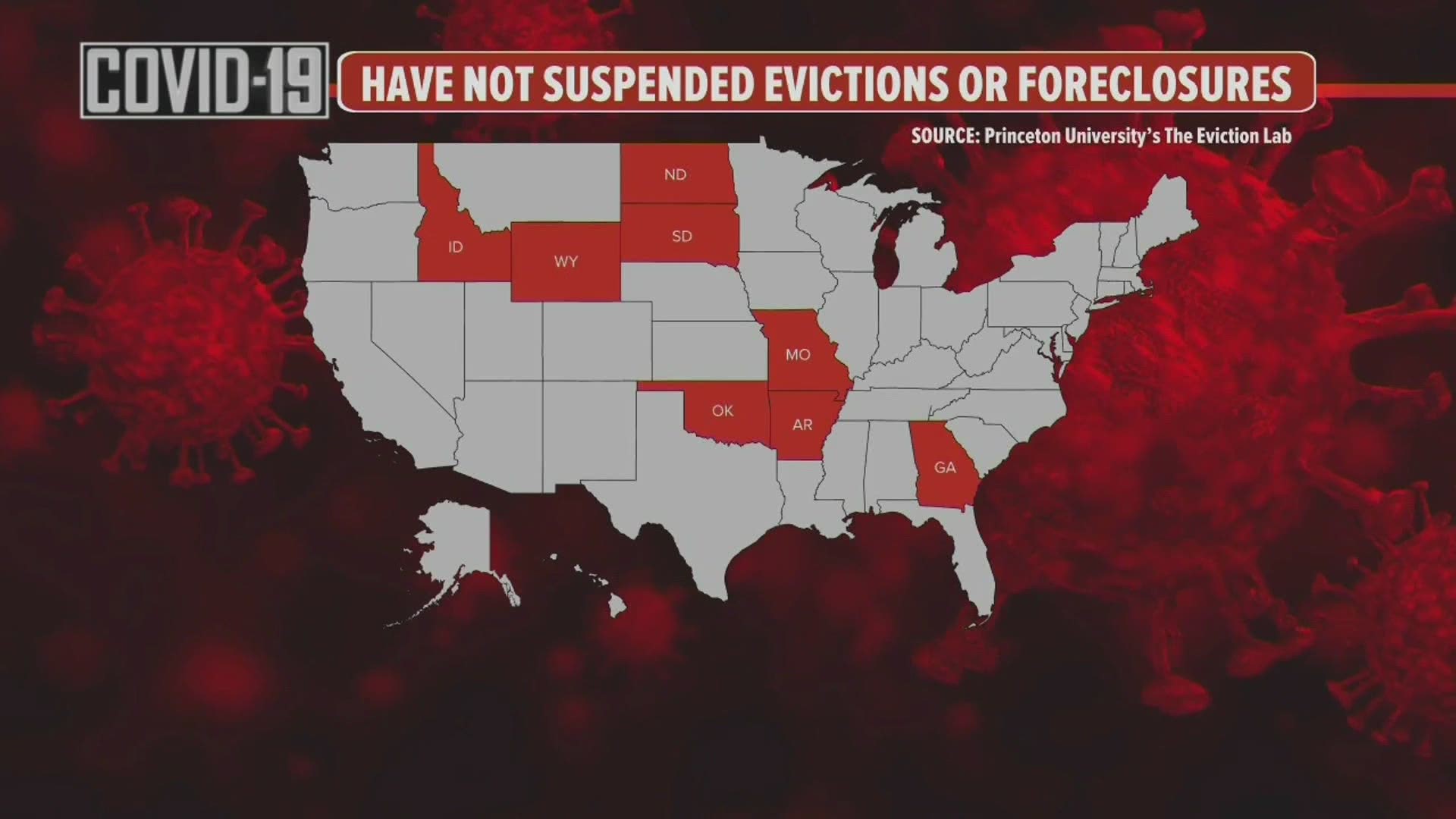

Evictions are on hold in the state of Iowa, but the default process is not.

That's the last thing anyone wants.

Talk to your mortgage provider and let them know your situation so you can work through any hardship together.

WATCH: Complete coronavirus coverage from Local 5 on YouTube