WEST DES MOINES, Iowa — One of the many aspects of the latest COVID relief bill set to be signed by President Biden later this week includes enhancements to the child tax credit.

Traditionally, the credit has been something taxpayers with children can claim at the end of the year when filing their taxes. Those credits help offset their end-of-the-year tax liability.

It's a credit that Waukee resident Heather Smith has counted on for years.

"We do have seven kids, so that child tax credit does help us out," said Smith.

The changes coming to the credit is something that Smith and her family are looking forward to.

"It'll definitely give our kids more opportunities," she said.

There are three key changes that Iowa families could feel the most.

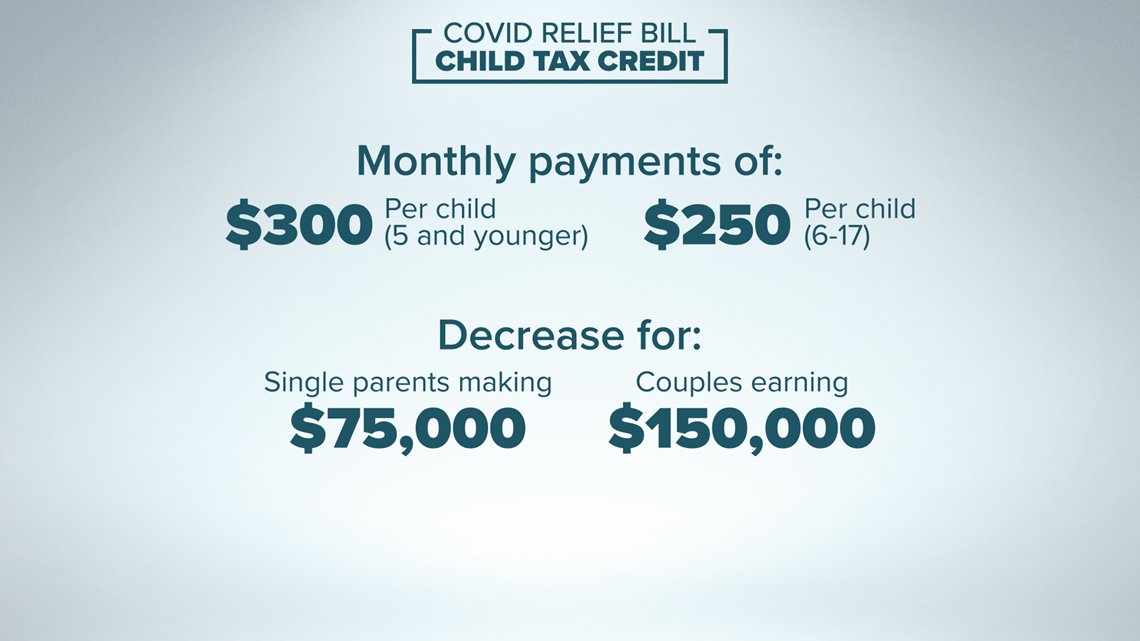

First, the amount of the credit is going up. For the 2020 tax year, the credit maxes out at $2,000 per child. That amount will go up for the 2021 tax year to as much $3,600 per child.

"This is going to pump a lot of money into households in Iowa," said professor Swenson, a research scientist and economist at Iowa State University.

Second, families won't have to wait until they file their 2021 taxes next year to see the credit. They could start receiving monthly payments of up to $300 per child starting in July of this year.

Professor Swenson said the money could have a "multiplier affect" for the local economy.

"It's the kind of money that households are going to spend," said Swenson. "They're going to spend it on childcare; they're going to spend it on support for their families. It's the kind of money that gets spent locally."

Tax professionals like Ann Hartz, president of Ann M. Hartz CPA and Associates, believes smaller regular payments versus a large sum at the end of the year could lead to change in spending behavior.

"People will make big purchases, maybe buy a car or something much larger, where if it was spread out throughout the year, I think it would go more towards just their living expenses and being able to maybe have a little more comfortable life," said Hartz.

As it stands now, if a taxpayer's tax liability is too low, they may not be eligible for the full credit even though they meet the income requirements. And that's what the third major change addresses. The tax credit would become fully refundable. That means that families whose income qualifies them for the full credit would receive the full credit.

Tax professionals are offering a word of caution to anyone who choses to receive the tax credit early.

"They should sit down with someone and make sure that they do have enough withheld and that they won't end up in trouble when it comes time to do their taxes that they would end up having to pay in because they...used that credit out throughout the year and now, there's nothing to offset that tax," said Hartz.

Smith and her family say they are planning for those implications and excited to see the money help their family and their community.

"Because we can meet our monthly bills, it will be things we can put back into the community. We can go have a family dinner all together," she said.